The world of finance is changing at lightning speed, and getting a desired place within this high-stakes profession is no longer a matter of choice but of survival that demands more than theoretical knowledge. An Investment Banking Course with placement is now no longer a luxury but a necessity for high-flying finance graduates. These courses are a bridge of connection between academic learning and professional achievement, equipping candidates with the skills, expertise, and actual industry experience required to thrive in aggressive jobs in investment banking.

Why Choose an Investment Banking Course with Placement?

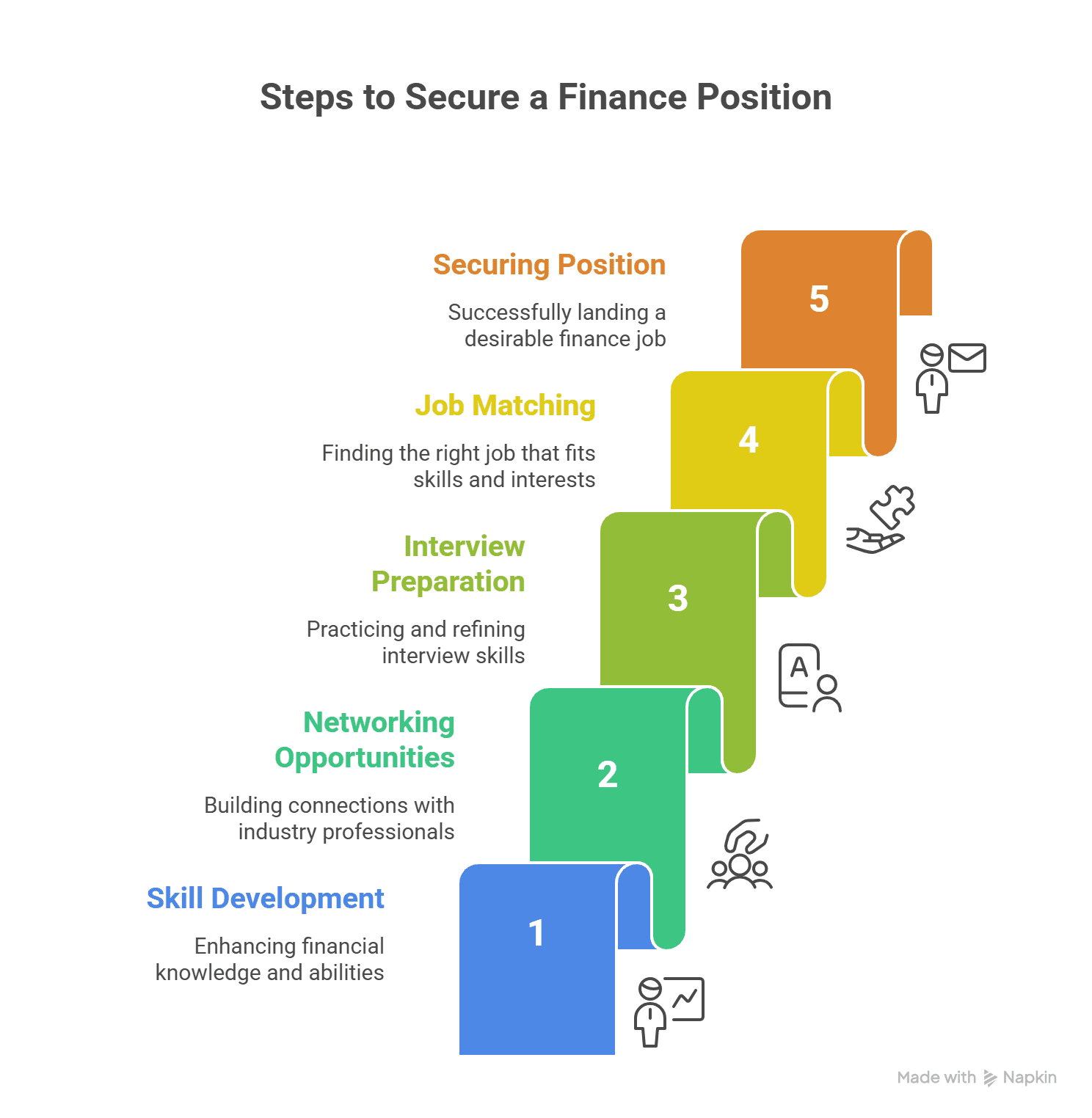

A placement-assisted course in investment banking provides a clear path to the best finance jobs. The curriculum is designed to match the latest industry trends, while the placement assistance ensures that students do not face the job market independently.

In India, where the financial industry is growing very fast, job-ready graduates are in huge demand. Along with the study of core finance concepts, these graduates are also given banking job readiness course training, such as resume building, mock interview sessions, and aptitude sessions, which enhances their chances of employment tremendously.

How Does Finance Placement Assistance Make a Difference?

One of the major reasons students choose such programs is placement support in structured finance provided. It’s not just investment banking training; it’s about stepping into a fulfilling career with ease.

Career guidance services usually provide:

- Preparation for aptitude tests

- Individual interview guidance

- Guidance from industry professionals

- Interview guarantees

Such all-round guidance not only makes the students academically equipped but also job-ready and confident.

The Rise of Job-ready Banking Programmes in India

The Indian economy is now a hub for innovation, competition, and fast-digitization. Job-ready banking courses step in here to fill the gap between industry and academia.

These courses blend theoretical finance learning and practical experience, with simulations, capstone projects, and real-case studies. Through this synergy, learning gets better, and students are adequately prepared to face real-life banking scenarios.

Unveiling the Power of an Investment Banking Course with Placement

A placement-based Investment Banking Course opens up a whole world of possibilities for finance specialists. Not only do these courses develop great investment banking ability, but they also expose one to potential employers directly.

No matter what you pursue – M&A advisory, risk management, equity research, or operations – placement-friendly courses will find you a good-paying job. The training not only puts book knowledge within you but also makes you banking world-ready in terms of handling complexity.

Top Investment Banking Skills Training You’ll Receive

The backbone of any career-readied course is its curriculum. A well-structured investment banking skills training course must offer:

- Financial statement analysis

- Risk management techniques

- Anti-money laundering (AML) procedures

- Ethical and compliant banking

- Operations in securities

- Wealth and asset management

All such modules form a strong foundation in banking and finance, allowing students to take a career call in any investment banking segment.

Key Highlights That Make These Courses Stand Out

What sets an elite investment banking course apart from others is the combined approach towards studying. These are some of the highlights:

- Project-first approach

- Simulation-based training

- Industry-experienced faculty

- Peer networking

- Guaranteed placement support

All these factors bring students fully under a learning environment replicating actual investment banking.

The Changing Landscape of Banking Career Growth in India

Career development in India’s banking sector is more lively than ever. The fintech trend boom, adoption of fintech, and global market integration lead to high demand for strong finance specialists withstanding challenges.

Placement-assisted courses are tailor-made to fulfill this function. These courses enable students to gain future skills and align themselves with the changing demands of high-caliber recruiters in the finance sector.

Certified Investment Banking Operations Professional (CIBOP)

The CIBOP™ program is an investment banking course with 100% job guarantee for finance graduates aged 0–3 years. It offers 7 guaranteed interviews, an 85% placement rate, and salaries of up to 9 LPA. With more than 1200 batches trained and 50,000+ students trained, it is a brand you can trust in the domain of investment banking training.

What You’ll Learn?

The CIBOP™ course goes deep into actual investment banking practices, such as:

- Securities operations

- Wealth and asset management

- Risk management

- Anti-money laundering

- Compliance and trade-based money laundering

- Ethical banking practices

Career Outcomes

After successfully completing the programme, you can become:

- Investment Banking Associate

- Wealth Management Associate

- Risk Management Consultant

- Collateral Management Analyst

- Regulatory Reporting Analyst

- Trade Surveillance Analyst

- KYC Analyst

- Settlement Associate

- Client Onboarding Associate

Additional Career Support

Imarticus Learning supports your career with:

Aptitude Training: Designed to assist you in passing employer tests

Profile Building: Guiding in creating a strong professional profile

Interview Preparation: Mock interviews and feedback from experts to enhance your performance

Award-Winning Programme

Imarticus Learning has been awarded the “Best Education Provider in Finance” at the 30th Elets World Education Summit 2024, thereby becoming a sought-after firm for financial training.

By joining Imarticus Learning, you’re not enrolling for a course. You’re investing in a promising, meaningful, and professionally rewarding future.

If you are a fresher or an aspiring candidate who is looking to get into investment banking, then it’s the correct time to start learning something new. The top Investment Banking Course with placement can transform your life—make the correct choice.

FAQs About Investment Banking Courses with Placement

1. What is an Investment Banking Course with placement?

It’s a comprehensive training program that equips students with hands-on finance skills along with systematic placement support to secure top career opportunities in banking.

2. How does finance placement assistance work?

It encompasses services such as aptitude training, mock interviews, profile creation, and interview guarantee through institutional connections.

3. Are these courses suitable for freshers?

Yes, the courses are perfect for finance students with 0–3 years of experience who desire a competitive advantage.

4. Which skills are covered in investment banking skills training?

Streams such as financial analysis, risk management, AML, wealth management, and compliance are generally included in the course.

5. What makes a job-ready banking programme effective?

Its work-oriented approach, revised syllabus, and placement training are the reasons why it is actually good.

6. Can I switch careers using these courses?

Yes. Such courses are designed so that even career-changers are given their rightful space in the banking industry.

7. How do I choose the right banking job preparation course?

Search for industry-specific course offerings, employer-validated placement rate success, qualified teachers, and project hands-on training.

Conclusion: Begin Your Journey to a Rewarding Banking Career

Following an Investment Banking Course with placement is the key to Indian and global high finance careers. These courses not only refine your technical skills but also make you the recruiters’ favorite. If you are ready to broaden your investment banking career faster, a well-planned course with job guarantee is the best option.

One of them making waves in the education arena for finance is Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP™) program.