Last updated on July 23rd, 2025 at 11:57 am

Last Updated on 8 months ago by Imarticus Learning

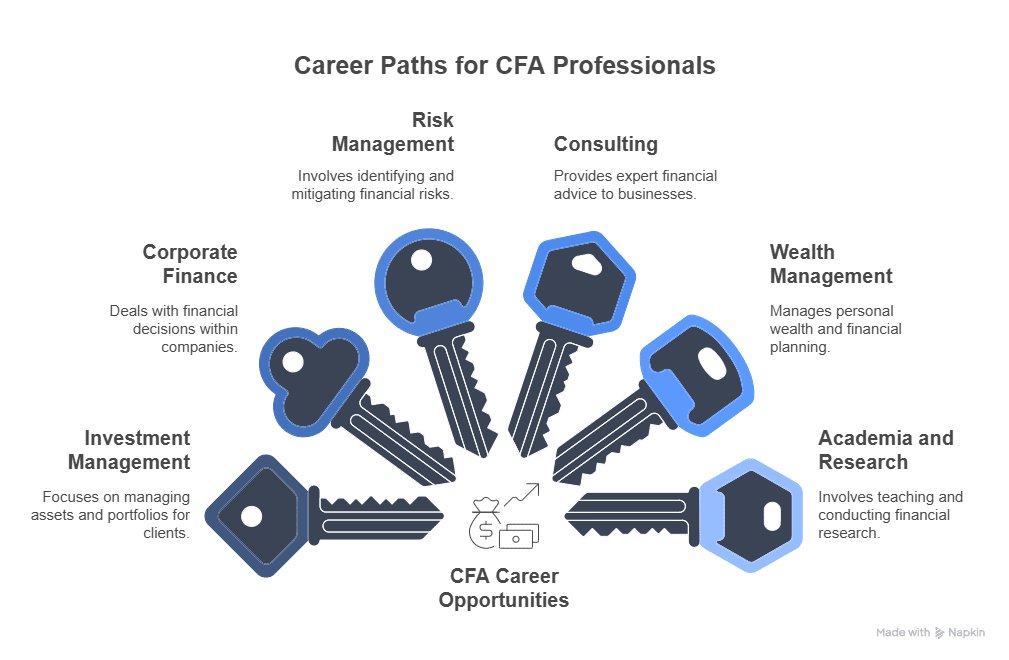

If you are planning to catapult your career to new heights in the finance sector, earning a Chartered Financial Analyst certificate can be your true breakthrough. The CFA certification is recognized worldwide and has become the standard in the financial and investment management sector. If you are residing in India or some other nation, post-CFA career opportunities are many, rewarding, and keep growing further.

The CFA program, carried out by the CFA Institute, focuses on ethics, investment tools, and portfolio management. Having over 1,90,000 CFA charterholders and 160+ societies of CFAs worldwide, this certification prepares you for senior finance roles and makes your employers believe in you. In this blog, we would discuss the most appropriate CFA career options, both at an Indian and international level.

What Does a CFA Charter Offer?

The CFA certification is not a qualification, it’s a professional oath of excellence in finance. Study topics are financial reporting, economics, corporate finance, equity investments, portfolio management, and ethics. Completing all three levels of the CFA exam opens doors to career opportunities that demand deep analysis and decision-making skills.

Whether you are looking for CFA international career or CFA careers following CFA in India, here is why the CFA qualification is unique:

- Internationally accepted qualification

- Investment skills focusing on real-life application

- Over 100 countries employer recognition

- Inner circle membership access to CFA societies and networking

CFA Career Options in India

1. Financial Analyst

It is one of the most common CFA careers after CFA in India. Financial analysts review financial data, make forecasts, and assist in making decisions.

2. Equity Research Analyst

Equity analysts review companies and industries to give buy/sell/hold recommendations. They write thorough stock as well as market scenario reports.

3. Credit Research Analyst

Credit research analysts review credit information and corporate balance sheets to exhibit amounts of risk.

4. Risk Analyst

Risk analysts find and manage risks to allow companies to reduce financial exposure. CFA knowledge of derivatives and fixed income is beneficial here.

5. Portfolio Manager

Portfolio manager constructs and maintains investment portfolios for institutions, clients, or funds. It is one of the better-paying finance careers apart from CFA.

6. Investment Banker

Although more MBA-related, even CFA charterholders are involved in M&A advising, IPO underwriting, and raising capital.

7. Corporate Finance Specialist

In finance department or corporate treasury roles, CFA professionals are responsible for budgeting, cost control, and financial planning.

CFA Job Roles Abroad: Global Career Expansion

1. Quantitative Analyst

Statisticians use statistical techniques and mathematical models to make investment decisions.

2. Fund Manager

CFA professionals operate extensive investment portfolios in foreign asset management firms, making crucial buy-sell decisions.

3. Wealth Manager

Provide HNIs and institutional investors with tailor-made investment solutions.

4. Chief Financial Officer (CFO)

Many CFA charterholders later pursue executive roles such as CFO in multinational organizations.

5. ESG Analyst

As there’s greater emphasis on sustainability, CFA professionals enjoy career prospects in ESG investing careers globally.

CFA Designation Job Prospects in 2025

The world of finance is evolving rapidly. The demand for analytical experts, ethic professionals, and investment professionals is higher than ever in 2025. Career opportunities for the CFA designation are plenty in sectors:

- Investment Banking

- Asset Management

- Private Equity

- Hedge Funds

- Consulting

- Corporate Finance

- FinTech

In India, business culture is keeping pace with the international level, and thus jobs after CFA in India are strategic and well compensated.

CFA Salary in India and Abroad

Below is a comparative summary of the CFA salary in India and abroad:

| Experience Level | Salary in India (INR) | Salary Abroad (USD) |

| Entry-Level | ₹7.5 – ₹10 LPA | $50,000 – $65,000 |

| Mid-Level | ₹12 – ₹15 LPA | $75,000 – $100,000 |

| Senior-Level | ₹20 – ₹35 LPA | $120,000+ |

The salary of a CFA in India continuously increases along with the demand, i.e., for big city and multinational roles.

CFA International Job Opportunities

There are several CFA international job opportunities for candidates from nations such as:

- United States

- United Kingdom

- Singapore

- United Arab Emirates

- Canada

- Australia

Foreign employers like JPMorgan Chase, Goldman Sachs, BlackRock, HSBC, and McKinsey. With growing globalisation, now Indian CFA charterholders are hired for overseas jobs.

Finance Careers After CFA: Industry-Wise Breakdown

Let’s classify CFA careers on an industry basis to get an idea of diversified opportunities:

1. Asset Management

Portfolio Manager, Research Analyst, Fund Manager

2. Corporate Finance

Treasury Analyst, Finance Business Partner, Strategic Finance Lead

3. Consulting

Valuation Analyst, M&A Consultant, Strategy Advisor

4. FinTech

Quant Analyst, Product Manager, Investment Strategist

5. Private Wealth Management

Wealth Manager, Financial Consultant, Family Office Analyst

Why Choose Imarticus for CFA Prep?

Imarticus Learning being India’s first approved CFA prep provider supported by:

1. Live Online Training

Highly interactive quality sessions to master CFA subject matter under live faculty mentorship.

2. Expert Faculty

Mentorship by CFA Charterholders and industry professionals with vast experience.

3. Kaplan Schweser Resources

Renowned study guides across the globe to make your preparation the best.

4. Placement Assistance

Placement boot camps, resume guidance, mock interviews, and network assistance.

5. Dual Teacher Model

24×7 guidance and mentoring along with classroom training.

6. Money Back Guarantee

Failed CFA exam? We refund your fee as per terms and conditions.

FAQs: Career Opportunities After CFA

Q1: What are the best jobs after CFA in India?

Most in-demand jobs are Financial Analyst, Portfolio Manager, Risk Analyst, and Investment Banker.

Q2: What is the average CFA salary in India?

Freshers can earn ₹7.5–₹10 LPA, whereas experienced professionals receive up to ₹35 LPA.

Q3: Can CFA charterholders work abroad?

Yes. CFA charter is recognized worldwide and offers opportunities for employment across over 100 countries.

Q4: What are the CFA international job opportunities?

Professionals can work as Fund Manager, ESG Analyst, Wealth Manager, and Quant Analyst.

Q5: Is CFA worth it in 2025?

Yes. With high return on investment, global recognition, and diversified career prospects, CFA is among the most prized finance certifications.

Q6: What sectors hire CFA charterholders?

Investment banks, consultancy companies, FinTech ventures, asset management companies, and corporates.

Q7: Can CFA replace MBA for finance roles?

Although both are coveted, CFA is investment and finance job-specific and highly preferred according to recruiters.

Q8: Do CFA charterholders get placement support from Imarticus?

Yes. Placement training and interview guarantee help are provided post-Level 1.

Conclusion: Shape Your Global Finance Future with CFA

The CFA charter is not just a certification—it’s a passport to high-end finance jobs in India and around the world. If you dream of working on Wall Street, for an Indian MNC, or launching a FinTech venture, CFA career opportunities are limitless.

Together with Imarticus Learning, not only are you getting world-class training but also professional mentoring, real-world learning, and confidence to lead the finance industry.

Design your finance future. Start your CFA in 2025.