Last updated on April 25th, 2025 at 09:14 am

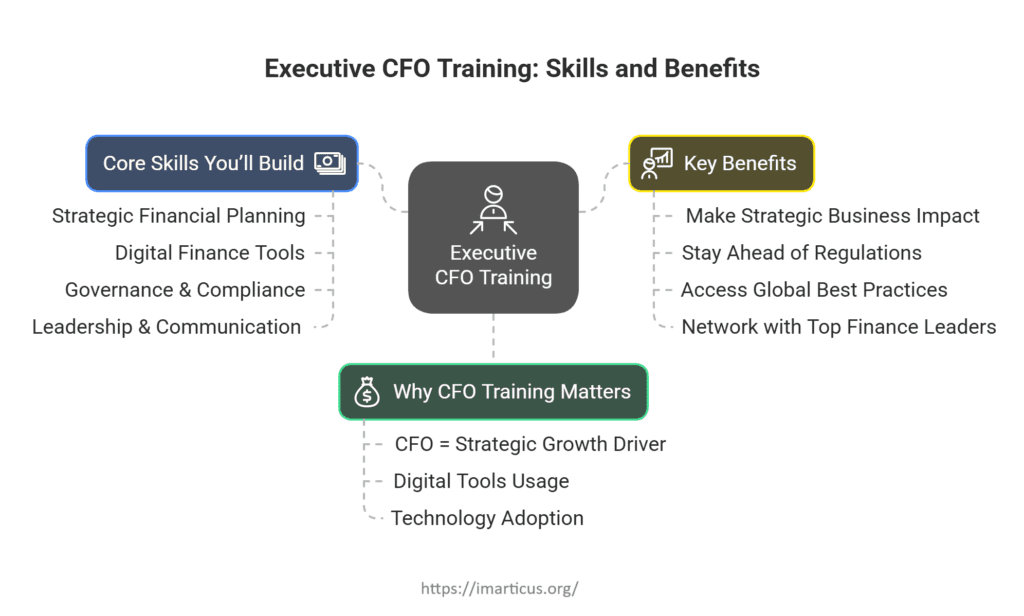

The role of the Chief Financial Officer (CFO)– has evolved beyond traditional financial management. Modern CFOs are expected to drive strategy, manage risk, and leverage technology for business growth. A chief financial officer training programme equips finance leaders with the skills to navigate economic complexities, regulatory changes, and digital transformation.

According to CXOToday, 72% of Indian CFOs prioritise digital solutions for decision-making, and 65% integrate AI, blockchain, and data analytics into their strategies. To stay ahead, enrolling in a strategic CFO program is essential for finance leaders aiming for sustainable business growth.

Key Areas Covered in CFO Leadership Training

- Financial Strategy and Decision-Making-

A CFO leadership training programme…helps executives master capital allocation, risk assessment & investment planning. This expertise ensures a company remains financially resilient even in volatile markets.

- Digital Transformation in Finance-

With advanced financial management techniques, CFOs can implement AI-powered analytics, blockchain solutions, and cloud-based reporting tools. 72% of CFOs in India are already prioritising digital adoption, making finance executive courses a critical investment for future-ready finance leaders.

- Corporate Governance and Compliance-

Understanding global and India-specific regulations-is a key focus of CFO certification courses. From SEBI-norms to corporate tax reforms, CFOs need a deep knowledge of financial governance-compliance & reporting standards.

- Leadership and Stakeholder Communication-

Modern CFOs act as strategic business partners, working closely with CEOs, investors& board members. A well-structured CFO leadership training course hones negotiation skills, strategic thinking, and stakeholder management.

Top Reasons to Enrol in a Chief Financial Officer Training Programme

- Enhance Your Strategic Impact – CFOs play a crucial role in shaping business growth. A strategic CFO program teaches finance professionals how to align financial goals with organisational strategy.

- Navigate Complex Financial Landscapes – With a 50% surge in CFO hiring amid IPO growth, the demand for skilled financial leaders is higher than ever.

- Access Global Best Practices – Top finance executive courses provide insights from leading finance faculty & industry experts.

- Stay Ahead of Regulatory Changes – CFOs must stay updated on tax laws, ESG reporting & financial compliance frameworks.

- Network with Industry Leaders – CFO programmes offer access to high-calibre peer networks and alumni groups, enhancing career growth.

Best CFO Certification Courses for Finance Executives

One of the most sought-after programmes is the Chief Financial Officer (India) Programme by London Business School (LBS) and Imarticus Learning. This programme blends global financial insights with India-specific financial strategies, preparing finance leaders for high-impact roles.

Learn more about this programme here:

The Future of CFOs: Trends and Innovation

1. Sustainability and ESG Reporting

With-83% of finance leaders emphasising sustainable finance, CFOs must integrate ESG (Environmental, Social, and Governance) principles into corporate financial planning.

2. The Rise of India’s Unicorn Startups

India now has 110+ unicorns, with CFOs… playing a critical role in financial planning, investor relations, and growth strategies. The right chief financial officer training can prepare finance professionals to lead high-growth companies.

3. Digital Finance and AI-Driven Decision Making

AI-driven financial forecasting and blockchain-based security systems are transforming how businesses handle financial operations. According to CXOToday, 65% of CFOs have already begun integrating these innovations.

How to Choose the Right CFO Training Programme?

When selecting a CFO certification course, consider-

- Global Recognition – Choose programmes affiliated with top-tier business schools like London Business School.

- Comprehensive Curriculum – Look for modules covering strategic finance, digital transformation & leadership skills.

- Industry-Relevant Faculty – Learn from finance professors and global CFOs.

- Networking Opportunities – A programme that offers executive alumni networks provides long-term career benefits.

For an in-depth understanding of the CFO role, check out these insightful reads:

The Role of CFO: A Strategic Business Partner

How the CFO Role is Evolving in Modern-Businesses

FAQs

1. Who should enrol in a CFO training program?

CFO training programs are designed for senior finance professionals, financial controllers, and business executives looking to transition into CFO roles or strengthen their leadership, financial strategy, and risk management skills.

2. What are the key benefits of a CFO leadership training program?

These programs help professionals develop strategic decision-making, advanced financial management, stakeholder communication, risk mitigation, and digital finance expertise, preparing them for executive leadership.

3. How long does a typical CFO certification course take?

The duration varies depending on the program. The London Business School CFO Program, for example, lasts… bc 6 months and includes online learning, masterclasses, and in-person immersions in Mumbai and London.

4. Do CFO training programs cover digital transformation?

Yes, modern strategic CFO programs emphasise digital finance, AI-driven financial decision-making, blockchain applications & data analytics, ensuring CFOs are equipped for tech-driven financial leadership.

5. Are CFO certification courses globally recognised?

Many CFO programs-especially those offered by renowned institutions like-London Business School… providglobally recognised certifications that enhance credibility & career opportunities.

6.How do CFOs benefit from networking in these programs?

Top finance executive courses offer-exclusive networking opportunities with global finance leaders, CFO mentors & alumni communities… providing lifelong learning & career advancement-opportunities.

7. What is the cost of a CFO training program?

Program fees vary. The London Business School CFO Programme costs-₹21,00,000 + GST… with flexible instalment options to make it accessible for professionals.

Conclusion

The role of the CFO is rapidly evolving, requiring finance professionals to develop strategic leadership, advanced financial management, and digital transformation skills. Investing in a chief financial officer training programme ensures finance executives stay ahead of industry trends & take on leadership roles with confidence.

For those seeking a world-class CFO leadership training experience…we highly recommend enrolling in the Chief Financial Officer Programme by London Business School & Imarticus Learning.