Table of Contents

Last updated on September 1st, 2025 at 01:04 pm

The world of investing looks quite complex but despite that, the modern generation seems to be more interested in it. People are more conscious of their money and the best channels of investment for it. When we talk about investments, it is important to start with understanding bonds, as it is one of the stable choices within the volatile realm of investments.

In this article, we will unravel everything from the fundamental nature of bonds to the contribution of investment banks in bond offerings. This information is not only helpful for any investor but for anyone who wants to pursue a career in investment banking or capital markets.

Let us delve into the fascinating world of one of the most reliable financial instruments.

Understanding the Financial Instrument-Bond

A bond is essentially a debt security, a loan made by an investor to a borrower, typically a government or corporation. Here, the issuer of the bond borrows a specified amount, known as the principal against which they agree to make periodic interest payments, usually twice a year. This culminates in the repayment of the principal upon maturity. Bond prices are inversely proportional to interest rates: when the rate goes up, the bond price falls and vice-versa.

Unlike stocks of a company, bonds do not give any ownership rights. This means that bonds signify a creditor-debtor relationship, emphasising stability and regular income.

The key characteristics of bonds are:

- Fixed Interest Rates

- Issue Price

- Face Value(representing the bond’s worth at maturity)

- Coupon rate (interest paid on the face value),

- Predetermined Maturity Dates

Who Issues Bonds?

Various entities issue bonds, encompassing national governments, municipalities, corporations, and government-sponsored agencies. Governments employ bonds to fund public projects, manage debts, and fulfil financial obligations. Municipalities issue bonds for local development ventures such as infrastructure, schools, or utilities.

Similarly, corporations utilise bonds to secure capital for expansions, acquisitions, or debt refinancing. Government-sponsored agencies issue bonds to support specific sectors like housing.

Bonds offer a means for multiple individual investors to act as lenders. Public debt markets enable numerous investors to each contribute a part of the required capital. Additionally, these markets permit lenders to trade their bonds among themselves or with other investors, even well after the initial organisation raised the funds.

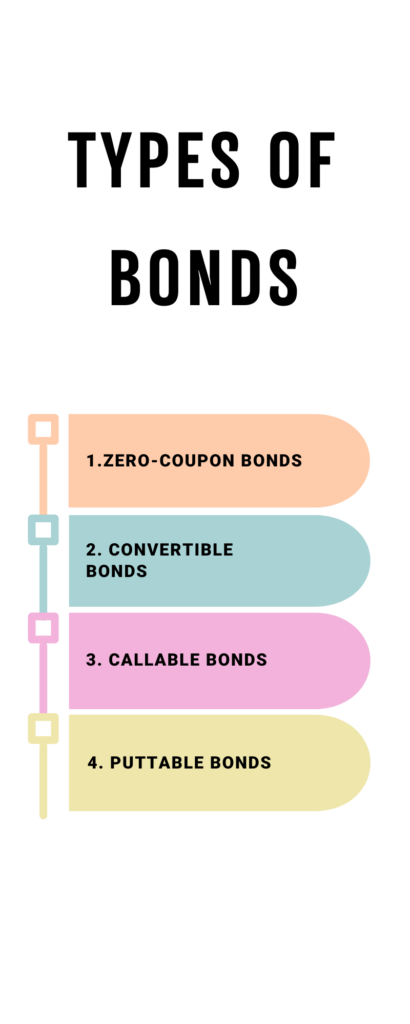

Types of Bonds

There are various types of bonds available for investors separated by the rate or type of interest or coupon payment. Some of them have special features as well. Below is a list of some common varieties of bonds that we must know of.

-

Zero-Coupon Bonds

These are fixed-income instruments that do not pay any periodic interest. Instead, these are issued at discounts to their face values and redeemed at their original values upon maturity. The absence of regular interest payments results in these bonds being sold at a lower price, providing investors with a profit upon maturity. Due to their structure, these bonds are more sensitive to fluctuations in interest rates and may experience higher volatility in their prices.

-

Convertible Bonds

Convertible bonds grant bondholders the right to convert their bonds into a specified number of the issuer’s common stock shares at a predetermined conversion rate. Investors benefit from potential capital appreciation through the stock conversion option. These bonds usually offer lower interest rates compared to traditional bonds but provide an opportunity for investors to benefit from potential increases in the issuer’s stock price.

-

Callable Bonds

These bonds allow issuers to redeem or “call” the bonds before their maturity date. This flexibility benefits issuers when interest rates fall, allowing them to refinance at lower rates. However, this can be disadvantageous for investors, potentially resulting in the loss of expected interest income if the bonds are called early.

-

Puttable Bonds

Puttable bonds give investors the right to sell the bonds back to the issuing authority before they reach maturity at a predetermined price. This feature offers protection to investors in declining markets, allowing them to sell the bonds back and mitigate losses. However, these bonds usually offer lower yields due to the embedded put option.

What is Bond Offering?

Bond offering is the process of issuing bonds and making it available for the investors to purchase. During this process, the entity sets the terms of the bond, like the interest rate, when it matures, and how much it’s worth. This information is usually in a document called a prospectus, which gives all the details about the bond.

Sometimes, investment banks help with bond offerings. They assist in pricing the bonds and finding people who want to buy them. These banks might buy all the bonds from the entity and then sell them to investors.

Bond offerings are a way for organisations to get money for different things, like building projects or paying debts. For people who invest, buying bonds in an offering means they’ll get regular interest payments and their money back when the bond ends.

Role of Investment Banks in Bond Offerings

Bond offerings play a pivotal role in facilitating the issuance of bonds by various entities seeking capital. Investment banks with their expertise in the field and the gathered insights arrange these offerings. Their involvement spans crucial activities, from pricing and underwriting to distribution, significantly influencing the success of bond offerings.

To comprehend the dynamics of raising capital through bond issuances, it is essential to understand the role of investment banks in it. Below are the specific tasks that are necessary for anyone wanting to become an investment banker.

-

Underwriting Expertise

Investment banks underwrite bond issues, assuming the risk by purchasing the bonds from the issuer and subsequently selling them to investors. They evaluate market conditions, gauge investor demand, and strategically set bond prices to ensure successful offerings.

-

Pricing Determination

These banks assist in determining the bond price for the offering, considering market conditions and investor expectations. Through thorough analysis and valuation techniques, they establish an attractive price that aligns with prevailing market dynamics.

-

Strategic Distribution

Leveraging their extensive network, investment banks strategically distribute bonds to potential investors. Their connections within the financial market enable effective marketing to both institutional and retail investors, broadening market access.

-

Advisory and Risk Management

Investment banks offer guidance to issuers, aiding in structuring offerings and preparing necessary documentation. They provide insights into market conditions, advise on timing, and manage risks associated with bond offerings, optimising the process for issuers and investors.

Conclusion

Understanding this intricate world of bonds is quite crucial for anyone pursuing an investment banking course or otherwise. Understanding bonds, a stable choice amidst market volatility, forms the foundation for investors navigating financial landscapes. In order to master this, there’s no better way than getting a certification in investment banking. And for that, you can enrol for the Certified Investment Banking Operations Professional course by Imarticus Learning. This industry-approved program will transform you into an expert in the field with the best investment banking operations programs.

Visit the official website of Imarticus for more details.