Last updated on March 26th, 2024 at 11:09 am

With a majority of the population having smartphones and instant digital access to their finances, a revolution in the digital finance sector is inevitable. The financial services and capital markets need to have a strong digital presence and find professionals who have strong knowledge and experience in this field. This is why a financial services and capital market course is in demand.

The major challenge of the banking sector is competing with the other technology companies and the leading brands that offer financial services. Financial services by the leading brands were unheard of in the past but they saw the potential and are reaping their benefits now. It is high time the banking, as well as the capital markets, find a way to establish their position in this digital finance revolution.

Technology in finance

The core of digitalization of the financial sector is the technology-based services that mainly use various software, Artificial Intelligence, and others including blockchain technology. The professional who deals with any type of fintech services must have a thorough knowledge in any or all of these areas.

A diploma course or a certification course of any duration is likely to offer expertise in these areas. Depending on the type and focus, the course includes basic or advanced modules of these sections.

Certification courses for fintech and capital markets

The first step towards a shift in financial technology is finding experienced professionals. This is where the certification courses come into the limelight. There are various types of certification courses available online and offline. Capital markets, new age banking, finance analysis, etc are some of the popular courses.

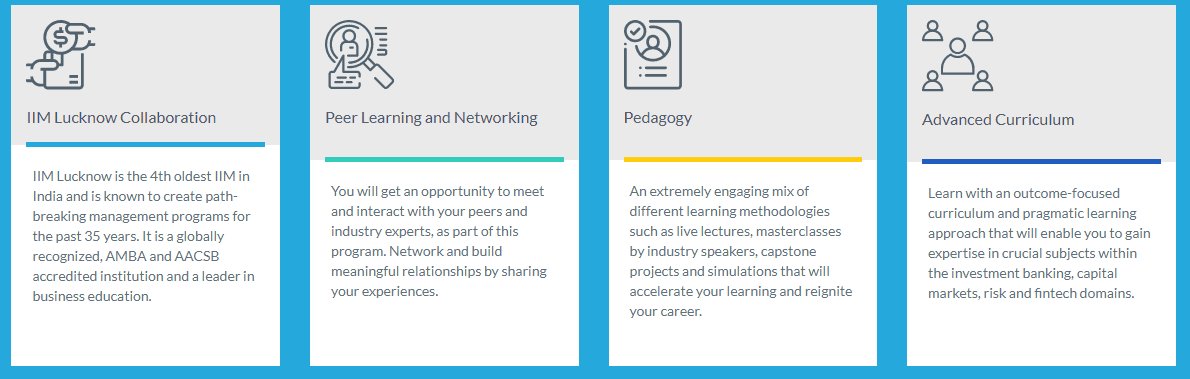

Among the various courses available online, one of the prominent ones is the Advanced Management Program In Financial Services And Capital Markets certification course by IIM Lucknow here at Imarticus. It’s a short-term course of 6 months duration. The highlight here is the 36 hrs on-campus experience at Lucknow.

The course is mainly offered for those with work experience and/or with a diploma in finance management.

The course is mainly offered for those with work experience and/or with a diploma in finance management.

The course offers input into corporate finance, accounting, and investment, all that is to know about the capital markets, as well as a meticulous module regarding risk management with various fields of fintech. This will be advantageous for a change in the profile or a career in the finance sector.

How do fintech courses help?

A certified capital market professional can provide the right input to help the customers create their strategies to improve their investments and benefits. Since corporate banking is the biggest in the finance sector, courses in investment banking and other financial management have a dedicated module for this subject.

The popular courses offer hands-on experience with case-studies from popular companies. It will help you prepare for your career in fintech services and capital markets. The purpose of digital finance is to ensure effective financial services that lead to profits for the clients or customers.

To achieve the same, we need the assistance of professionals such as a capital market operations consultant, financial market advisor, investment banking operations lead, etc. Services of such professionals are necessary to make digital financial services effective and beneficial for all parties involved. It stays true, whether it is the government, corporations, individuals, banks, or other financial institutions.

Bottom Line

It’s not wrong to say that these certification courses in financial services are an integral part of the digital revolution in fintech and capital markets. Choose the right certification course to improve your career along with the economy.