Last updated on March 21st, 2024 at 10:43 am

Many people think that credit risk and analysis is a dying industry. They believe that technology or computers in the future will take it over. However, this couldn’t be further from the truth.

In reality, Credit risk and underwriting degrees are becoming more critical in today’s world because they teach people to work with numbers and use them effectively for decision-making purposes.

Skills for Credit Risk Analysts:

A career in credit risk and underwriting requires a diverse skill set. You must understand the intricacies of various industries, have excellent analytical skills, and have an in-depth knowledge of accounting principles. However, it’s not just about the technical aspects.

A successful candidate also needs to possess some New Age Skills such as leadership abilities, communication skills, and negotiation experience. New skills must be learned to stay on top of the latest trends. One of these new skills is programming, which can help with data analytics and automation.

Here are some other common skills required for a Credit Risk Analysts:

Strong quantitative & analytical skills: Credit Analysis requires digging into financial statements & analyzing credit risks using tools like ratio analysis. Hence having an analytical mind is important.

Knowledge of financial analysis: A Credit Analyst must know their way around financial statements & develop a knack to find items impacting the company’s debt-paying abilities. Risk analysis is a part of their job profile and may demand analysis of different scenarios.

Attention to detail & diligence: Errors made in assessing creditworthiness can be costly for the entity & stakeholders too.

Communication skills: Credit Analysts course prepare financial standing reports, which needs excellent report writing skills. They are also required to interact with company management & clients, to scrap out information & discuss problems. Good people with oral communication skills excel as credit analysts.

Comfort with Financial/Statistical software: Credit analysis requires risk analysis using statistical software. Knowledge & comfort working on such platforms is an advantage.

Comfort with Financial/Statistical software: Credit analysis requires risk analysis using statistical software. Knowledge & comfort working on such platforms is an advantage.

Move up the Ladder with Imarticus Learning:

A Credit analyst’s job is challenging and demands analytical solid skills. Looking for careers after graduation, you can get placed as junior analysts/management trainees assisting analysts. However, to move up on the ladder, you may need a Master’s degree or certification courses like CFA/CA/FRM.

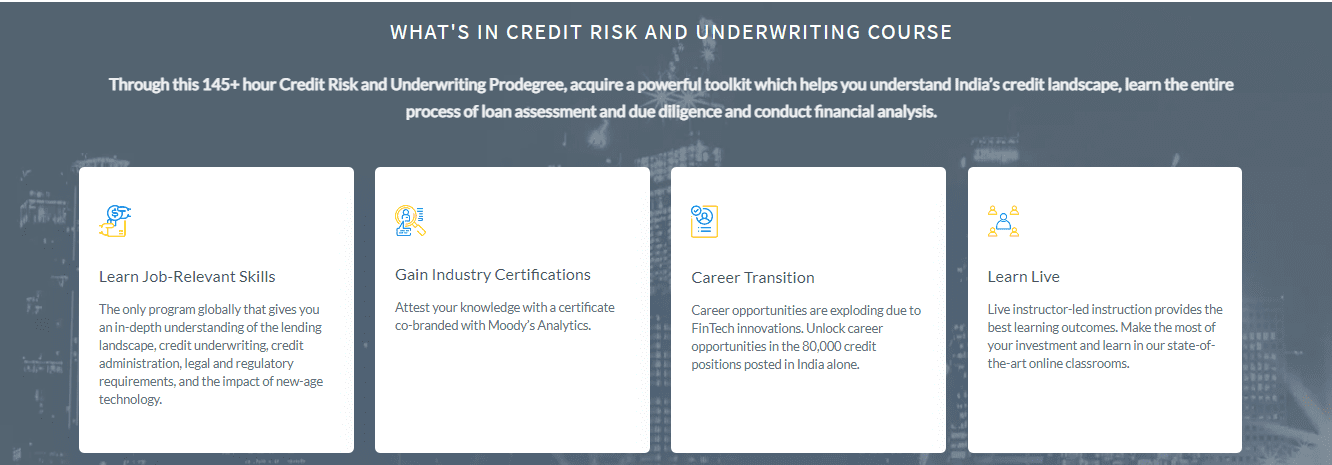

Imarticus Learning offers Credit Risk and Underwriting Prodegree that helps you carve a career in Credit Risk Underwriting. Students get an in-depth understanding of the dynamic banking & non-banking financial corporations (NBFC) loan markets during the program.

Through this Credit Risk and Underwriting Prodegree, students acquire a powerful toolkit that helps them understand the credit landscape, learn the entire process of loan assessment and due diligence and conduct financial analysis. The students get hands-on learning experience and explore five comprehensive case studies linked to different aspects of the curriculum.

Through this Credit Risk and Underwriting Prodegree, students acquire a powerful toolkit that helps them understand the credit landscape, learn the entire process of loan assessment and due diligence and conduct financial analysis. The students get hands-on learning experience and explore five comprehensive case studies linked to different aspects of the curriculum.

After completing this course, students are rewarded with an industry-recognized Certificate of Excellence in credit risk & underwriting. The certification represents the skills & knowledge they have imbibed during the course and can be used to boost your portfolio and resume. To answer your questions like what after B.Com? This CRU Pre-degree is the answer!

For further details on business analytics courses in India, contact us through the Live Chat Support system or visit our training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Hyderabad, Delhi, Gurgaon, and Ahmedabad.