Last updated on March 26th, 2024 at 11:30 am

Last Updated on 2 years ago by Imarticus Learning

Introduction

Wealth management is an advisory service where a wealth manager advises his/her clients in making better financial decisions. A wealth manager makes sure that financial services and resources are used appropriately to generate profit.

Wealth managers can be found in a lot of sectors like estate planning, retail banking, tax processes, investment sector, etc. A wealth manager also focuses on sustainable development i.e. using resources in such a way that they could be preserved for the future.

Let us see more details about the wealth management career.

Wealth management Education

If you are thinking to start your career in wealth management, the first and foremost requirement is to have the necessary set of skills. You need to have a bachelor’s degree in mathematics, finance, economics, management, business, etc. You can also take wealth management courses via the internet. Many wealth managers go for a CFA (Chartered Financial Analyst) course as it helps them in gaining skills for senior wealth management job roles.

Besides education, you also need to do internships to get a basic idea of working culture in the wealth management sector. A lot of institutes/colleges offer summer term internship program or you can grab an internship off-campus. You will learn about updating client portfolios, mutual funds management, financial analysis & research, etc.

With the help of education & internships, you will learn about the basic skills required in the wealth management sector such as analytical skills, financial understanding skills, market analysis skills, forecasting skills, etc. Getting a good education or certification is the first process in building a successful Wealth management career.

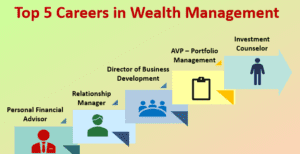

Career Path in Wealth Management

Once you have completed your education and are ready to work, you can apply for various wealth management job roles. There is a lot of opportunity in this sector. According to the U.S. Bureau of Labour Statistics, the growth rate predicted in the wealth management sector is 15% from 2016 to 2026 which is much higher.

You can work as a wealth manager in a financial advisory firm, retail bank, investment bank, or as a freelancer. You will grow your reputation as a wealth manager over time. The more you help your clients in achieving their financial goals or booming their business, the more is your demand as a wealth manager in the market.

Job Roles in the Wealth Management Sector

There are a lot of different job types in the wealth management sector. Let us see some major wealth management jobs:

• Investment Counselor –

They focus on the financial relationships of his/her client. They keep analysing the market and ping their clients whenever a good investment opportunity occurs. They also work in investment banks advising clients on whether to invest in any particular venture or not.

They focus on the financial relationships of his/her client. They keep analysing the market and ping their clients whenever a good investment opportunity occurs. They also work in investment banks advising clients on whether to invest in any particular venture or not.

• Portfolio Manager – They usually work with HNI clients. They are responsible for updating and analysing client portfolios.

• Business Developer – They help in the growth of their client’s business by maintaining good financial relationships. They usually work with ultra HNI clients.

Financial Advisor – They help in making financial strategies and models. They are also considered with insurance-related problems. A personal advisor can work for a firm or as a freelancer.

Financial Advisor – They help in making financial strategies and models. They are also considered with insurance-related problems. A personal advisor can work for a firm or as a freelancer.

These were some of the major job roles in the wealth management sector. It usually depends on the firm/company that what type of services are they expecting from a wealth manager.

Conclusion

You can learn more about the skills required in the wealth management sector via various Wealth management courses available on the internet. This was all about the Wealth management career path and what opportunities are waiting for you in this field.