Last updated on December 5th, 2023 at 09:13 am

Last Updated on 2 years ago by Imarticus Learning

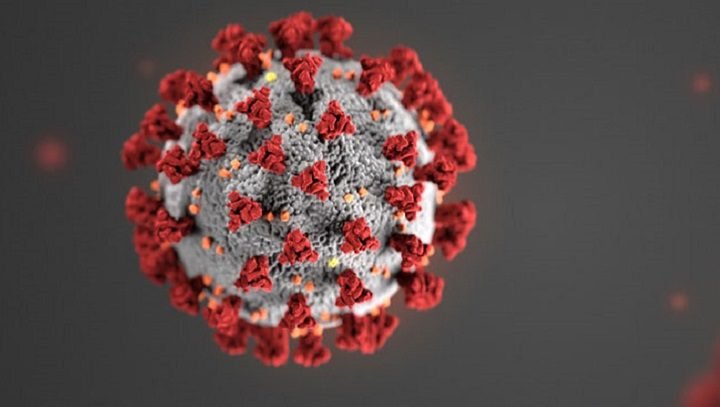

The COVID-19 pandemic has so far infected over a million people and killed over 50,000 people, and has spread to more than 200 countries. While at some locations a handful of cases were reported, others with early community transmission have a few hundred. Unfortunately, at geographies with widespread transmission have reported thousands of cases.

Economic Disruptions

This pandemic has caused major disruption to global economies owing to the containment measures and lockdowns all over. It is quite evident now that because of the virus-containment measures global economies will be hit to a great extent. Lockdowns, social-distancing and other coronavirus-containment measures have led to a massive fall in the global economic activity – plummeting consumer demand, fall in crude oil prices, crash in global stock markets, and equally decreasing global banking revenues.

Going by the words of leading financial experts, a global recession cannot be ruled out. The decrease in demand and disrupted supply chains will eventually have a domino effect on other parts of the economy, causing the next global economic recession. Numerous financial institutions and banks have already cut their forecast for the global economy.

2019 witnessed a downward slide in global investment banks revenues; with ambiguity about the duration of this pandemic and vaccine release, the ongoing pandemic will continue to rattle trading revenues and global investment banks in 2020 as well. Over the past few weeks, billions of dollars have been taken out from credit lines and reduced the investor wealth.

The global banking industry, already under stress, will be impacted further due to consumer sentiments and ongoing liquidity concerns. The coronavirus shockwaves are rippling through the investment banking industry across the world, forcing investors to pull out their money from the credit lines; this has led to experts warning of severe liquidity crunch and a credit crisis. Asset managers are rewriting how they locate deals, manage their portfolio companies, and engage with promoters of potential targets.

Despite a decent start to 2020, virus-induced panic caused some of the worst market selloffs in February and March, with commodities prices and equities falling to new lows. The investment banking industry experts expect more price falls and continued volatility in the short term. This will require portfolio adjustments of scores of institutional investors.

Increased Market Volatility

The rise in global market volatility will cause the issuance activity to decrease which will hurt the investment banking revenues to a great extent. Economists are now pinning their hopes on the containment of this deadly virus; if not contained soon the damage can be enormous to the investment banking industry. The current market situation is similar to the selloffs in the fourth quarter of 2018 and in the first quarter of 2016 when transaction volumes plummeted after investors reshuffled their portfolios.

Containment Factor

Although it is still unclear how long the epidemic will last, investment strategists expect containment sooner rather than later in the year, and still hope for a quick rebound of the economy. However, strong monetary and fiscal policy responses under way could set the stage for a second-half rebound.

Also Read: How Corona Virus Impacting Financial Sector