Certified Investment Banking Operations Professional (CIBOP™)

Investment Banking Operations Professional (CIBOP™)

Salaries upto 9 lPA

100% Job Assurance

12 years of excellence

7

Interviews Guaranteed

60%

Salary Hike

1200+

Batches Completed

50,000+

Learners

4 LPA

Average Salary

1000+

Hiring Partners

Why Investment Banking Operations Professional (CIBOP) Program?

Our Certified Investment Banking Operations Professional (CIBOP™) program has been guiding finance professionals for over a decade, shaping careers and turning dreams into reality.

Focused on real-world scenarios and insights from industry experts, the refined curriculum of our investment banking course addresses intricacies in securities operations, wealth and asset management, financial market, risk management, and anti-money laundering. Imarticus offers more than just a certification, it delivers a transformative experience, propelling you toward greatness in the investment banking operations realm.

Our Curriculum

Core Module

Topics

- Financial System – Structure & Design

- Equities

- Fixed Income Securities

- Derivatives

Beyond Classroom

Learning Outcomes

Assesments

Specialization

Track 1- KYC & Transaction Monitoring

Track 2- Wealth & Asset Management Operations

Topics

- Introduction to KYC in Investment Banking

- Introduction to Anti- Money Laundering

- KYC Remediation

Beyond Classroom

Learning Outcomes

Assesments

Our Faculties

Our Alumni work at

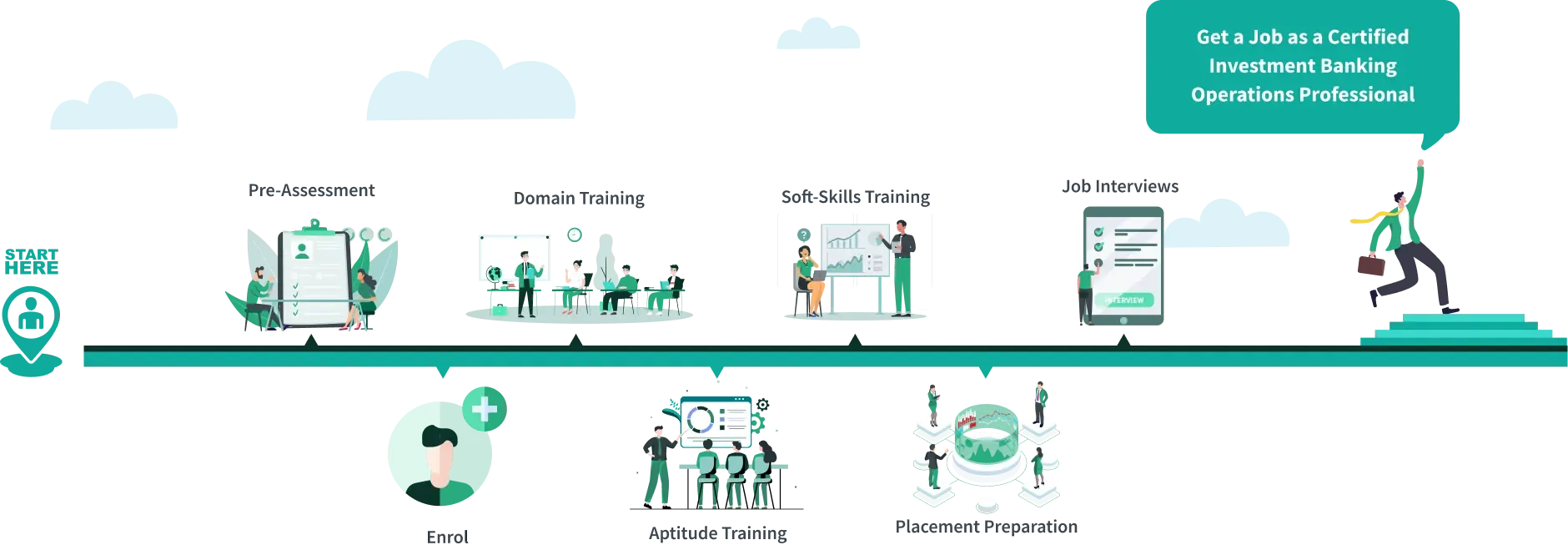

Your Learning Journey

Certification

Upon successful completion of our Certified Investment Banking Operations Professional Program, you'll receive a professional certificate, enhancing your value and propelling your career toward growth.

Earn Your Certificate

Share your Achievement

Reviews

We Have An 85% Placement Success Rate

Learn more about how we’ve been impacting thousands of careers.

Investment vs Return